CNBC to Andersen: “Are we selling America?”

Peter Andersen on Schwab Network

Peter Andersen on Mornings With Maria Bartiromo

Peter Andersen on Schwab Network

Peter Andersen on Schwab Network

Peter Andersen on Mornings With Maria Bartiromo

Peter Andersen on Reuters 12.13.2024

Andersen Capital Management on Bloomberg Intelligence

Andersen Capital Management on Mornings with Maria Bartiromo

Andersen’s latest article published in Forbes Intelligent Investing

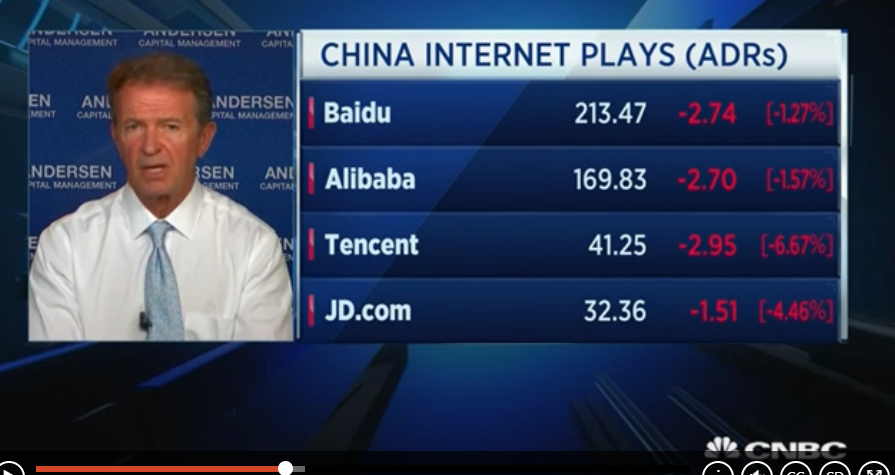

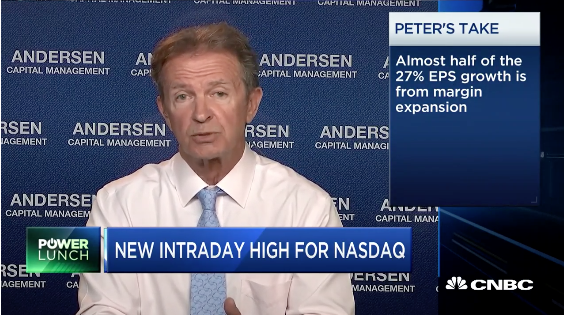

Andersen Capital on CNBC Power Lunch

Andersen Capital: The Fed’s Mistakes Continue

Andersen Capital on Mornings With Maria: The Fed’s Recent Decision

Andersen on the Fed & AI: The Truth that No One Likes to Hear!

“The Fed & AI”

“Time to Trim”

“Defining Sell Triggers for A.I.”

“Rotation into small cap? Way too early to declare!”

Andersen to CNBC: Here are my AI sell triggers!

Andersen to Bartiromo: NVDA doesn’t care about interest rates!

When to Sell the A.I. Rally

Andersen’s latest article published in Forbes — Common Sense Is AI’s Glass

Ceiling

Andersen on Schwab TV: Preparing for an “AI Betrayal”

Andersen on CNBC: How I logged in 60% net returns for 2023

Andersen to Maria B: I’ll never buy Apple stock–here’s why:

Andersen on Schwab Network–My outlook for 2023 never changed:

Andersen Capital, up 43% YTD, says to Reuters: “I’ll Never Buy Apple Stock”

Andersen to CNBC: I LOVE 5% rates!

Andersen Capital to FBN: “Higher rates for longer” is really “Normal rates for longer

Andersen to CNBC the market will rally in Q4

Andersen on Schwab Network TV: Lets stop the pointless economic abstract debates and focus on practical stock picking for a change…

Andersen to Reuters TV: The Fed’s next moves through year end:

Andersen on FBN: Is the Fed’s 2% inflation target a natural law or simply from New Zealand?

Andersen Capital Ranked 5th in Pension and Investments for one year return; CNBC interview on stock selection process:

Andersen’s latest article published in Forbes–A true perspective on AI: Rare!

Andersen on Reuters TV: Market Outlook

Andersen on CNBC today: What can go right (and wrong) in the 2nd half of the year:

Andersen on Bloomberg radio today–reality check on AI’s prospects compared to public expectations, and realistic stock picks. I have done the deepest dive on AI out there–you might find my view disappointing!

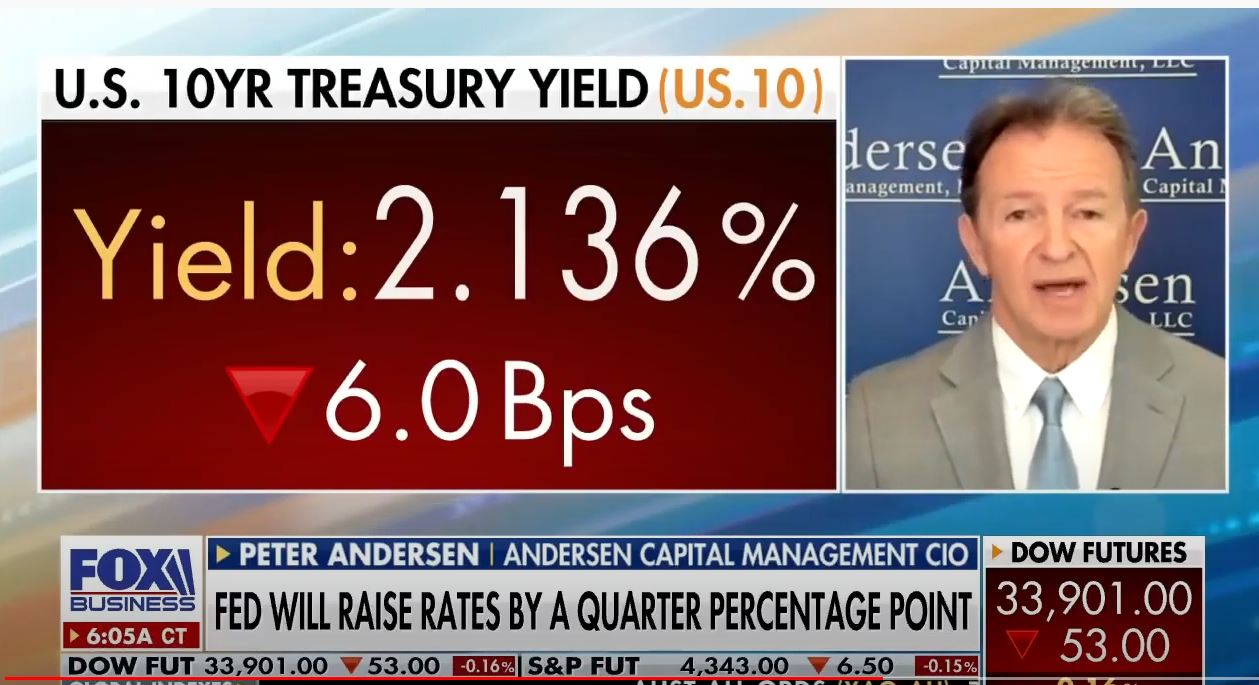

Andersen on FBN TV: only 3 of the 10 rate hikes are impacting the current economy now:

Andersen on Reuters TV: six more months of optimism?

Andersen on FBN TV: Did you know AI has been around for a long time, quietly working in the background? Chatbots simply made the public suddenly aware. How will this impact investing in AI?

Andersen on TD Ameritrade Network TV: Market Outlook; Risk of AI Bubble; Stock Picks:

Andersen to Reuters TV: AI is over-hyped….and that debt ceiling?

Andersen on FBN: Debt Ceiling Worries? “Nothing to see here folks…move along please!”

Andersen to Reuters TV: AI? Both fans & doomsayers need a dose of reality:

Andersen to Bartiromo: Let’s not get ahead of ourselves about AI!

Andersen to Bartiromo: Why do older banks have such huge lobbies? Andersen’s answer is timely!

Andersen to Reuters TV–“The 2nd oldest profession (banking) meets a new profession (media “influencers”) supercharging a classic bank run:

Andersen on CNBC: Dancing between raindrops (or volcanic ash?) to a 16% return:

Andersen on TD TV: The absence of valuation supports crypto as “religion”

Andersen to Bartiromo: Is this the end of all crypto?

CNBC: Andersen buys NVDA and COTY stock

Andersen on CNBC:

Andersen Capital to Reuters TV: The Fed’s good work—artfully timing the smaller hikes with the pending effects of last year’s hikes.

Andersen’s thoughts “Morning Trade Live”–crypto recovery a head fake & the value of shorting stocks

Andersen to Reuters TV: If the experts confidently predict a recession–why aren’t they all in cash?

Andersen to Cheddar TV–even Santa has no market edge this year, but crypto presents unlikely

Andersen is a Forbes columnist: The fallacy of an inverted yield curve and why we should not care!

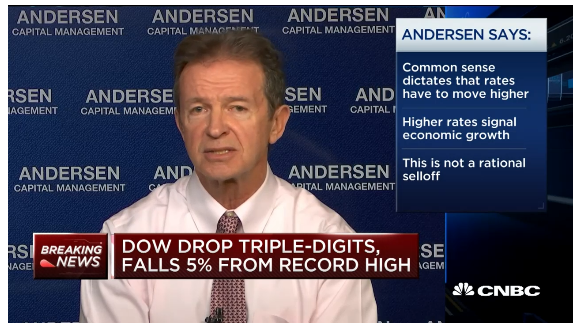

Andersen on CNBC: The yield curve is not a divine message sent from the heavens—we construct it ourselves…

Andersen to Reuters TV: I don’t expect much fallout from China/Covid—but I do care about the Fed & crypto!

Andersen on FTX: Crypto’s complicated nature compounds the “whodunit” discovery:

Andersen on Reuters TV: Market Outlook

On FBN: Is the Fed on a predetermined course?

https://video.foxbusiness.com/v/6312966644112#sp=show-clips

Andersen to Bartiromo: Stock Ideas for 2023

Andersen on Reuters TV: Fed, rates…and crypto craziness

On CNBC: Anyone that needs to repair a clogged artery (Shockwave Medical) won’t cancel the procedure because of higher interest rates or inflation!

On CNBC: Few stocks are trading on fundamentals now…why?

Andersen on Reuters TV: These stocks are immune to higher rates:

Andersen on Reuters TV: On Record against all Crypto!

Andersen is a Forbes Columnist: “Intelligent Investor” series

Andersen with Maria Bartiromo:Inflation mania; growth stocks misunderstood; Musk Madness!

Andersen to CNBC: 4 Ways to Cope with Earnings Season

Andersen on FBN: Market Outlook

Andersen to CNBC: These stocks are my current shorts:

On CNBC: Why I only own 14 stocks

Andersen on Cheddar TV: Market Update

Twitter/Musk bid–a classic governance case that many are too timid to discuss honestly—Andersen on FBN:

Andersen article in Forbes:

I was not allowed to express my opinion on “quant investing” while I worked in large investment firms for obvious reasons

Andersen on FBN: It helps to separate all the market’s problems in order to find a roadmap:

Andersen in WSJ today—everyone calm down please…

THE WALL STREET JOURNAL

Fox Business: I expect another huge selloff in crypto:

Cheddar TV: 5G–More antennas than you can imagine! 1000 per square mile!

Bloomberg Radio: Investing, Rate Hikes, & Value Versus Growth

CNBC: Equities could become a “stockpicker’s market” in 2022

On FBN: Crypto — “discussed by many, understood by few” –is not an investment strategy

FBN: Suddenly crypto is an inflation hedge? It’s only a “FOMO” hedge!

CNBC: There are still plenty of stocks to buy, says Andersen who saw 40% returns in 2020

Andersen to Bartiromo: Most bitcoin investors would be challenged to explain what is actually is:

Andersen to FBN: Thoughts on the debt ceiling, congressional bills and investment strategy.

Andersen to CNBC: Stick with stocks that depend less on inflation:

How high can the SP500 rise? My answer on FBN:

Andersen with Maria Bartiromo: The Fed doesn’t know any more than we do!

Andersen to CNBC: Here’s a roadmap for present times

Andersen to CNBC: Growth

Stocks Are On Sale Now!

Andersen on Maria Bartiromo: These Stocks Still Have Much Potential

Andersen Capital Posts Back-to-Back 40% Returns for ’19 & ’20

Andersen Comments on the Gamestop Phenomenon

Where’s the conviction?

Andersen Featured in Barron’s:

Trade wars? Ignore the beautiful blonde, Forbes

“Don’t worry about oil prices or 3% rates” CNBC

(subscribers only)Financial Times asks me if giant LBOs are possible:

CNBC asks my view on earnings

Andersen on CNBC: Earnings season

Are big dividend stocks in your future?

Andersen to Marketwatch: Trump’s AMZN tweets

Why is Facebook impacting Nvidia?

CNBC: Wall Street prefers street smarts over book smarts

Forbes: Feynman Diagrams, Euler Theorems, oh my!

Big selloff today; What’s causing it? CNBC

My Latest Forbes Article: Don’t Sell All REITs!

My Thoughts on the Market Selloff: CNBC Feb5th 201

Disclosure:

This is for informational purposes only and prospective investors are encouraged to contact or consult with the professional advisor of their choosing. Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of reparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decisions. Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.